Copyright © Petroliam Nasional Berhad (PETRONAS) (20076-K).

All rights reserved.

- PETRONAS 50

- Our Passion

- Sustainability

-

Progressing Energy

- Overview

- Exploration

- Development & Production

- Malaysia Petroleum Management

- Refining

- Chemicals

- Carbon Management

- Marketing, Trading & Retail

- Gas Business

- Liquefied Natural Gas (LNG)

- Gas & Power

- Innovation Gateway @ PETRONAS (iG@P)

- PETRONAS Ventures

- Technical Solutions

- SEEd.Lab

- Talent Development & Education

- PING

- Lubricants

- Investor Relations

- Our Stories

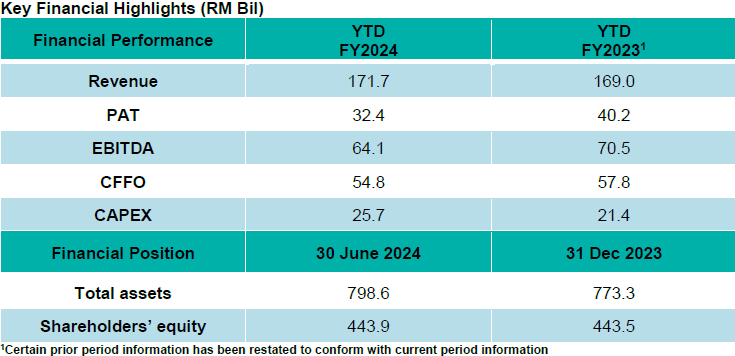

KUALA LUMPUR, 5 Sept 2024 – PETRONAS recorded RM171.7 billion in revenue for the first half of 2024 (1H 2024), a slight increase from RM169.0 billion in the corresponding period last year, mainly due to the impact from foreign exchange. This was partially offset by lower average realised prices, especially for LNG in tandem with declining benchmark prices.

Despite the higher revenue, the Group’s Profit After Tax (PAT) decreased by 19 per cent to RM32.4 billion, primarily attributable to the deconsolidation of subsidiaries and higher taxation during the period.

The Group recorded Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA) of RM64.1 billion, lower by RM6.4 billion or 9 per cent, in line with lower profits.

Cash Flows from Operating Activities (CFFO) stood at RM54.8 billion, a decrease of RM3 billion or five per cent, in line with lower profits generated during the period.

Capital investments (CAPEX) amounted to RM25.7 billion mainly from the development and exploration activities in the Upstream business. Domestic CAPEX increased by 18 per cent against the same period last year.

Total assets increased to RM798.6 billion as at 30 June 2024 against RM773.3 billion as at 31 December 2023, mainly contributed by capital investments during the financial period.

Shareholders’ equity increased to RM443.9 billion, mainly attributable to profit recorded during the financial period partially offset by dividends declared to shareholders amounting to RM32.0 billion.

PETRONAS President and Group CEO, Tan Sri Tengku Muhammad Taufik said:

“PETRONAS registered commendable performance in the first half of 2024, amid continued market volatility and global economic slowdown, bearing testimony to our commitment to prudent financial management and the strength of our diverse portfolio.

As we cross the 50-year mark, PETRONAS remains unwavering in its duty as a National Oil Company to deliver long-term sustainable value for Malaysia’s economic growth. Since inception, PETRONAS has injected RM1.4 trillion into the nation’s economy through dividends, taxes and cash payments.

Having evolved into a global energy player in this time, PETRONAS will continue to strengthen collaboration with forward-looking partners both at home and abroad, accelerating the adoption of technologies and the execution of our Energy Transition Strategy to pave the way for future growth.

While we expect to see more dynamic shifts in the operating landscape for the rest of the year, PETRONAS is steadfast in pushing on all fronts across our integrated business with a clear strategy and firm capital discipline, anchored on our purpose as a progressive energy and solutions partner to all the societies we serve.”

Outlook

The prolonged geopolitical tensions and macroeconomic uncertainties remain the key drivers of heightened volatility that continue to negatively impact the global market. Amid the complexities of this challenging and dynamic landscape, PETRONAS remains agile in recognising and prioritising opportunities for growth.

The Group is committed to preserving value through cost rationalisation and value-focused investments, both domestically and internationally. Notably, it remains progressive in monetising Upstream resources while advancing efforts in the renewable energy space.

As PETRONAS commemorates its 50th anniversary, the Group's priorities remain centered on ensuring energy security and fostering continued collaboration with stakeholders to safeguard the nation's interests and support nation-building efforts.

Reference

Click here to view PETRONAS Group Financial Report

Click here to view PETRONAS Group Financial Operational Report

Refer Appendix for Sustainability & Social Impact and Operational Highlights

APPENDIX

Sustainability Highlights

Greenhouse Gas (GHG) Emissions

During 1H 2024, PETRONAS has recorded GHG emissions of 21.78 million tonnes of carbon dioxide equivalent (Mil tCO2e) for its Malaysia operations, a 5.1 per cent reduction as compared to 1H 2023 (22.95 Mil tCO2e). The reduction was due to continuous improvements including reduced flaring and venting of our operations.

Health, Safety and Environment (HSE)

Lost Time Injury Frequency (per million man-hours) recorded as of 1H 2024 is 0.13 per million manhours which is an increase by 18 per cent (1H 2023: LTIF 0.11 per million manhours).

PETRONAS’ Social Impact Investment

As of 1H 2024, PETRONAS has contributed over RM230 million towards its social impact programmes. The contribution was delivered through more than 270 activations, under the three focus areas of Powering Knowledge (Education), Uplifting Lives (Community Well-being and Development), and Planting Tomorrow (Environment).

OPERATIONAL HIGHLIGHTS

Upstream

- Recorded average total daily production of 2,482 thousand barrels of oil equivalent (boe) per day in 1H 2024, higher than 2,425 thousand boe per day recorded for the same period in 2023, mainly due to higher natural gas production within and outside Malaysia.

- Achieved first hydrocarbon production for five projects in Malaysia and two in South Sudan, final investment decisions (FIDs) for 12 projects (seven in Malaysia and five outside Malaysia), and one exploration discovery in Suriname.

- Expanded portfolio in Indonesia through a 20-year extension for the Ketapang Production Sharing Contract (PSC) and a multi-year contract for the Bobara Working Area, and acquired 50 per cent share of the Papua New Guinea Petroleum Prospecting License.

- Awarded two PSCs, including:

- Late Life Asset PSC for Banang field to Petra Energy Development Sdn Bhd for full participating interest.

- Small Field Asset PSC for NBE Cluster to Vestigo Petroleum Sdn Bhd for full participating interest.

- Progressed CCS implementation with signing of Master Price Agreement with DNV, a global certification service provider, as well as through CCUS advocacy which resulted in the CCUS regulatory framework being tabled to the Cabinet of Malaysia by the Ministry of Economy.

Gas & Maritime Business

▪ Gas

- As at 1H 2024, Overall Equipment Effectiveness (OEE) for Gas Business stood at 92.6 per cent across all business segments.

- Delivered 192 liquefied natural gas (LNG) cargoes from the PETRONAS LNG Complex in Bintulu to customers across the globe.

- Delivered 19 LNG cargoes from PETRONAS’ Floating LNG facilities, PFLNG Satu and PFLNG Dua.

- Completed 2,320 MMscfd of average sales gas volume delivered in Peninsular Malaysia

- Completed 139,000 m3 of LNG Bunkering Vessel deliveries to the marine industry in Malaysia.

- Delivered 491 Virtual Pipeline System trucks to remotely located customers across Malaysia.

▪ MISC Berhad

- Secured a long-term Time Charter Party Contracts with PETCO Trading Labuan Company Ltd via its petroleum arm, AET, for the world’s first two ammonia dual-fuel Aframaxes.

- Entered into a Joint Venture Agreement with PETRONAS CCS Ventures Sdn Bhd and Mitsui O.S.K Lines, Ltd to establish a joint venture company to procure and own liquified carbon dioxide (LCO2) carriers for transporting LCO2 to CO2 storage sites.

- Established a MoU with Darussalam Pilotage Services Sdn Bhd to advance maritime education and research collaboration.

Downstream

- Downstream operations were stable with OEE of 88.7 per cent comparable with 89.0 per cent recorded in 1H 2023.

- Chemicals business recorded higher sales volume in line with higher production volume.

- Overall marketing sales volume stood at 12.35 billion litres, a decrease from 12.81 billion litres in 1H 2023, due to divestment of stakes in Engen Limited.

- In alignment with Malaysia's Low Carbon Mobility Blueprint (LCMB) 2021-2030, PETRONAS Dagangan Berhad inked a Memorandum of Understanding (MoU) with PLUS Malaysia to develop hybrid super stations along major highways, offering a convenience-oriented lifestyle in response to the energy transition and changing consumer preferences.

- PETRONAS completed the divestment of its 74 per cent stake in Engen Limited to Vivo Energy following the approval obtained from the Competition Tribunal of South Africa.

OPERATIONAL HIGHLIGHTS

Gentari Sdn Bhd

Renewables

- Achieved additional 0.7 GW of installed and under construction capacity in 1H 2024, contributing to a cumulative capacity of 3.6 GW to date, of which 2.4 GW is installed capacity.

Hydrogen

- Formalised joint venture with SEDC Energy in a document exchange ceremony to develop a global scale hydrogen production hub in Malaysia.

Green Mobility

- Established a network of 864 charging points across Malaysia, India and Thailand to date.

- Deployed a combined fleet of 3,874 electric vehicles (EV) under Vehicle-as-a-Service across Malaysia, India and Indonesia. Cumulatively, Gentari has clocked in approximately 32.9 million electric kilometres driven, contributing to carbon avoidance of around 928 tCO2e.

- Partnered with eCommerce company Lazada Group to pilot the electrification of its logistics operations with the introduction of 25 eBikes for last-mile delivery. This initiative, launched by Malaysia’s Minister of Investment, Trade and Industry, complements the government’s Electric Motorcycle Use Promotion Scheme.

- Partnered with premium automobile manufacturer BMW Group Malaysia to activate new EV charging facilities at The Exchange TRX, deploying a combined 13 units of 22kWh AC chargers.

- Signed MoU with insurance and takaful operator Zurich Malaysia to explore solutions aimed at promoting a sustainable lifestyle, including installing green mobility infrastructure at Zurich Malaysia's premises nationwide and offering value added services at other selected public locations.