Hak Cipta © Petroliam Nasional Berhad (PETRONAS)(20076-K).

Hak Cipta Terpelihara.

- PETRONAS 50

- Tekad Kami

- Kemampanan

-

Memajukan Tenaga

- Umum

- Eksplorasi

- Pembangunan & Pengeluaran

- Pengurusan Petroleum Malaysia

- Penapisan

- Bahan Kimia

- Pengurusan Karbon

- Pemasaran, Perdagangan & Peruncitan

- Peniagaan Gas

- Gas Asli Cecair (LNG)

- Gas & Tenaga

- Innovation Gateway @ PETRONAS (iG@P)

- PETRONAS Ventures

- Penyelesaian Teknikal

- SEEd.Lab

- Pembangunan Bakat & Pendidikan

- PING

- Minyak Pelincir

- Hubungan Pelaburan

- Cerita Kami

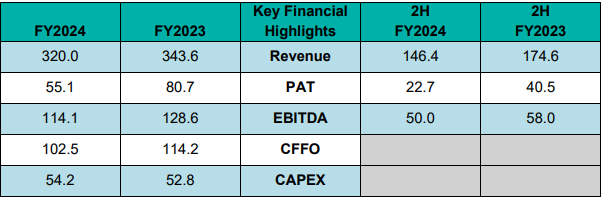

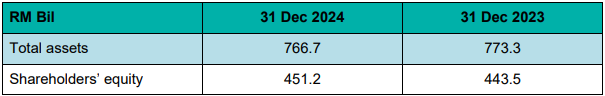

Key Financial Highlights (RM Bil)

Against 31 December 2023

KUALA LUMPUR, 25 Feb 2025 – For the financial year ended 31 December 2024, PETRONAS recorded lower revenue due to lower average realised prices.

FY2024 (Analysis against FY2023)

- Revenue stood at RM320.0 billion, a decrease of 7 per cent from the previous year, due to lower average realised prices, negated by higher sales volume. In addition, the 2024 revenue only included five months of Engen Group’s financial results until its divestment in May 2024.

- Profit After Tax (PAT) decreased by 32 per cent to RM55.1 billion in line with the lower average realised prices and favourable tax adjustments in 2023. The unfavourable realisation of foreign currency translation reserve, upon divestment of the Engen Group, also impacted PAT.

- The Group recorded a lower EBITDA of RM114.1 billion, in line with lower profits.

- Cash Flows from Operating Activities (CFFO) stood at RM102.5 billion, primarily driven by EBITDA.

- Capital investments (CAPEX) stood at RM54.2 billion, mainly attributable to activities in Malaysia.

- Total assets stood at RM766.7 billion.

- Shareholders’ equity increased to RM451.2 billion, mainly attributable to profit recorded during the year.

Second Half FY2024 (Analysis against Second Half FY2023)

- Revenue declined to RM146.4 billion, in line with lower average realised prices largely from petroleum products, and the divestment of Engen Group.

- PAT declined by 44 per cent to RM22.7 billion, in line with lower average realised prices and favourable tax adjustments in 2023 mainly due to recognition of deferred tax assets.

- EBITDA decreased to RM50.0 billion in line with lower profitability.

PETRONAS President and Group CEO, Tan Sri Tengku Muhammad Taufik said:

“PETRONAS' financial performance in 2024 remained resilient against a backdrop of continued volatility in the markets and mounting regulatory pressures caused by global geopolitical shifts. The steady results were delivered on the back of the Group's steadfast commitment to prudent financial management and portfolio diversification.

As the industry contends with evolving market dynamics that will extend beyond 2025, PETRONAS has set in motion a transformation strategy to strengthen its ability to deliver value to our shareholders and stakeholders, energy to our customers, and positive impact to the communities we serve.

Through firm discipline in capital allocation and cost rationalisation, strengthened collaborations and new partnership models, as well as operational and commercial excellence, PETRONAS will become more value-centric, globally competitive, and agile in responding to market changes.

PETRONAS continues to be committed in supporting Malaysia's economic growth and energy security, as its National Oil Company. It is envisaged that this transformation will better position this institution to continue upholding the mandate entrusted to it under the Petroleum Development Act 1974."

Outlook

The energy industry dynamics in 2024 were shaped by geopolitical instability, evolving policies and regulations, and economic uncertainties, significantly impacting oil and gas prices. As we look ahead to 2025, PETRONAS is strategically positioned to meet rising energy demands while ensuring supply security. The Group is set to navigate the challenges by maximising the potential of its assets, prudent financial management as well as productivity and efficiency improvements in the Group’s endeavour to remain a high-performing organisation.

As Malaysia's National Oil Company, PETRONAS is dedicated to supporting the nation's energy security and economic growth, as demonstrated by the progress of the Kasawari Gas Field Development and PETRONAS Floating LNG 3, and the completion of Integrated Bekok Oil projects.

Internationally, PETRONAS is committed to future-proofing its portfolio through strategic investments in the ongoing development of LNG plant in Canada and Upstream ventures in Angola and Indonesia. Additionally, the Group has invested in lower carbon projects and specialty chemicals plants, in pursuing its Energy Transition Strategy.

Reference

Click here to view PETRONAS Group Financial Report

Click here to view PETRONAS Group Financial Operational Report

Refer Appendix for Sustainability & Social Impact and Operational Highlights

APPENDIX

Sustainability Highlights

Greenhouse Gas (GHG) Emissions

In 2024, PETRONAS recorded greenhouse gas (GHG) emissions of 46.0 million tonnes of carbon dioxide equivalent (CO2e) for its Malaysia operations. This is in line with its near-term GHG emissions target of 49.5 million tonnes of CO2e from its Malaysia operations, a milestone in its Net Zero Carbon Emissions (NZCE) by 2050 Pathway.

The Group's total GHG emissions under operational control in 2024 amounted to 54.7 million tonnes of CO2e.

In line with the aspirations set under the Oil & Gas Methane Partnership 2.0 (OGMP 2.0), PETRONAS has refined its methane emissions measurements, quantification and reporting. As a result, the company has been recognised with the OGMP 2.0 Gold Standard Pathway for 2024.

Health, Safety and Environment (HSE)

Lost Time Injury Frequency (per million man-hours) recorded as of 2024 was 0.10 per million manhours, a decrease of 9.1 per cent from 2023. (2023: 0.11 per million manhours).

PETRONAS’ Social Impact Investment

PETRONAS contributed over RM850 million towards social impact programmes. The contribution was delivered through more than 400 activations under our three focus areas, Powering Knowledge (Education), Uplifting Lives (Community Well-being and Development) and Planting Tomorrow (Environment).

OPERATIONAL HIGHLIGHTS

Upstream

- Recorded average total daily production of 2,451 thousand barrels of oil equivalent (boe) per day in 2024, higher than 2,431 thousand boe per day recorded for the same period in 2023, mainly contributed by the maximisation efforts for liquid and natural gas production from both international and domestic operations.

- Achieved first hydrocarbon production for 21 projects in Malaysia and Indonesia, 17 final investment decision (FID) projects (11 in Malaysia and six outside Malaysia), and 19 successful exploration discoveries in Malaysia, Egypt and Suriname.

- Signed 14 Production Sharing Contracts in FY2024 under:

- Malaysia Bid Round (MBR) 2024: SB306A, SB306B and PM515 (Exploration PSCs)

- MBR 2024 and MBR+: Banang, BETA, DEWA Complex, Erb South, Ketapu, NBE, PKNB, Puteri, RAJA, Seligi NAG and Ubah Cluster (Discovered Resource Opportunities PSCs)

- Expanded in Abu Dhabi with the third concession of Onshore Block 2.

- Made significant progress for carbon capture and storage (CCS) in the second half of 2024:

- Acquired land from Kuantan Port for the Southern hub

- Entered into a Joint Study and Development Agreement (JSDA) with ADNOC and Storegga to evaluate the storage capabilities of saline aquifers and build facilities in the Penyu basin

Gas & Maritime Business

- Overall Equipment Effectiveness (OEE) for Gas Business stood at 92.6 per cent across all business segments.

- Delivered 35.7 MMT (548 BCe) of liquefied natural gas (LNG) to customers across the globe, out of which:

- 25.13 MMT (398 BCe) LNG cargoes from the PETRONAS LNG Complex in Bintulu.

- 2.17 MMT (36 BCe) LNG cargoes from PETRONAS’ Floating LNG facilities, PFLNG Satu and PFLNG Dua.

- Completed 2,315 MMscfd of average sales gas volume delivered in Peninsular Malaysia

- Signed 7 contracts for vessel newbuilds which will be added to the existing portfolio of 102 total LNG, Petroleum and Product vessels under the Maritime business.

- Own a total of 12 Floating Production Storage and Off-loading (FPSO) units and Floating Storage and Off-loading (FSO) units under the Maritime business.

- Achieved significant business through strategic portfolio expansion and key partnerships:

- Signed a 15-year agreement with ADNOC for the Ruwais LNG Project, securing the supply of 1 MTPA of LNG.

- Achieved first oil production from the Marechal Duque de Caxias FPSO unit.

- Reached FID for a 100 MW power plant in Kimanis, Sabah.

Downstream

- Downstream recorded improved OEE of 91.2 per cent in 2024, an increase from 87.2 per cent in 2023.

- Chemicals business recorded a higher sales volume in line with higher production volume. Total marketing sales volume stood at 21.1 billion litres, with PETRONAS Dagangan Berhad achieving an all-time high annual sales volume.

- PETRONAS, Enilive and Euglena reached FID to construct a biorefinery located within PETRONAS’ Pengerang Integrated Complex, Johor.

- Perstorp, a wholly owned subsidiary of PETRONAS Chemicals Group Berhad, introduced Synmerse™ DC, a high-performing cooling solution based on a readily biodegradable synthetic fluid that enhances operational safety, cooling efficiency, and reduce fluid maintenance for immersion cooling in data centres.

Gentari Sdn Bhd

Renewables

- Secured a cumulative global installed and under construction capacity of approximately 8 GW as of 31 December 2024.

- Signed a Memorandum of Cooperation – Renewable Energy (MOC-RE) with PetroVietnam to advance ASEAN grid interconnectivity through the export of renewable energy from Vietnam to Malaysia and Singapore.

- Expanded renewables portfolio in India:

- Commissioned first wind turbine of approximately 200 MW.

- Secured a 400 MW utility-scale wind-solar hybrid project.

- Delivered 650 MW round-the-clock renewables for India’s first renewables-green hydrogen production with AM Green Ammonia India Pte Ltd.

Hydrogen

- Pursued advancements in hydrogen infrastructure and clean energy partnerships:

- Exploring cross-border hydrogen exports via pipeline from Malaysia to Singapore with Senoko Energy Pte Ltd.

- Joint exploration of shipping and floating solutions for clean ammonia with MISC Bhd.

Green Mobility

- Established a network of 1,060 charging points across Malaysia, India and Thailand as of 31 December 2024.

- Deployed a combined fleet of 3,486 electric vehicles (EV) under Vehicle-as-a-Service (VaaS) across Malaysia, India and Indonesia. Cumulatively, Gentari has clocked in approximately 57.4 million electric kilometres driven, contributing to carbon avoidance of around 1,910 tCO₂e.

- Partnered with Perodua Sales to establish charging facilities at its service centres ahead of Perodua’s EV launch.

- Supported Putrajaya’s low-carbon goals with a new EV charging station via Perbadanan Putrajaya Co (PPj) as part of PPj’s plan to install 100 charging points by 2030.